Vanderlande Whitepaper

Passenger Load, COVID-19 Update

In November 2019, we released a white paper on the impact of passenger load on baggage handling systems (BHS). At the time of release, year over year passenger growth was expected with no signs of slowing down anytime soon. However, in less than 4 months, a completely different scenario developed

and the previous expectations of year over year growth are far from realistic.

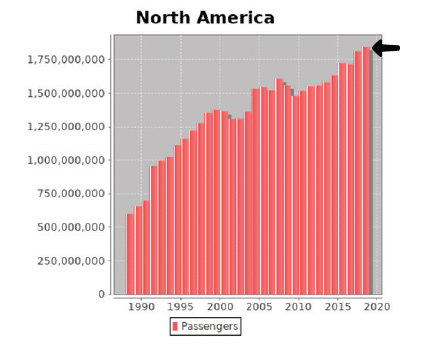

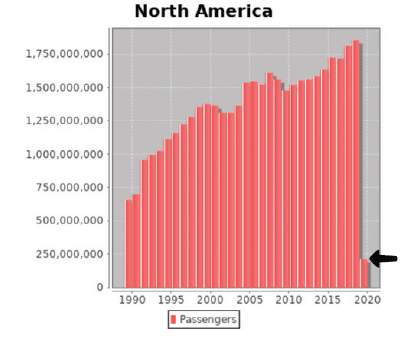

The COVID-19 pandemic has severely impacted the aviation industry on a scale never seen before. The uncertainty of the COVID-19 pandemic, makes it difficult to predict when travel, especially international/intercontinental, will return to normal. In the past, the aviation industry has faced several crises of varying degrees, resulting in minimal to no growth, or in the worst-case, decreased passenger numbers of only a few percentage points. Based on current data from the Albatross Database, we can see the drastic drop between previous expectations in passenger growth and

the current expectations (bottom).

The latest PAX projections estimate a 72% decrease in global passenger volume in 2020. The North American market is expected to decline even more drastically, with a projected 88% reduction compared to the 2% growth achieved in 2019.

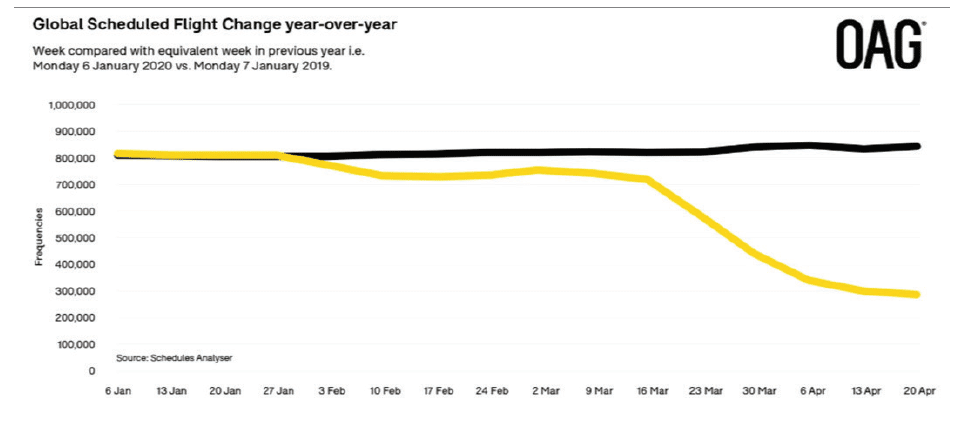

In the graph from the Offical Aviation Guide (OAG) website (right page), you can see the drastic differences between the number of flights in March and April compared to the same period last year. There are 64% fewer flights on a global scale compared to the previous year. Additionally, airlines are taking additional health precautions by making sure that next to each booked seat, there is an empty seat, which negatively impacts load capacity. These factors are causing massive hits to the capacity of airlines, who are not only reducing the number of flights but also able to carry fewer travelers. To mitigate the financial burdens of the reduced capacity, airlines are implementing several strategies. Some airlines are re-configuring their flight schedules by planning for a full return and then canceling flights that are impacted by COVID related issues. Others are scaling back the number of flights or deferring service to specific markets due to a lack of passenger demand.

Airlines have to quickly switch from investing in their business one day, to doing everything they can to save it the next. Airlines and airports are taking intensive measures to preserve their businesses, such as:

- Refinancing aircrafts and retiring older planes earlier than planned

- Reducing FTE, imposing hiring freezes, and offering pilots and flight attendants furloughs

- Getting financial aid from the government (US government already announced a $50 billion aid package)

- Delaying or scrapping short to medium term investments

- Grounding aircraft and reducing domestic and international flights

IATA estimates the air transport industry’s revenue could plummet $252 billion — 44% below 2019’s figure. However, this estimate is based upon the scenario that the current travel restrictions and bans will last three months. If this situation extends beyond July 2020, there is a strong possibility that smaller regional airports might have to temporarily close their doors — making some areas of the country less accessible. Larger airports have stronger financial buffers to persevere longer but, they are suffering too.

Larger airports are feeling the massive impact of fewer passengers through lost concessions revenue, reduced revenue from gate time slot sales, less parking revenue, and other non-flight related revenue streams. With many industries affected, the chances are high that a new recession is on the horizon. Passenger growth is not expected in the near future. Therefore, the need for these larger airports to expand or invest in their facilities will likely be lower. Their first priority is to keep their doors open, mitigate the inevitable losses as much as possible, and be ready when traffic picks up again.

IATA has developed several scenarios on how recovering of the aviation industry might happen. According to IATA’s press release on March 24, 2020, based upon a slow recovery scenario, where severe restrictions on travel are lifted after three months, they say the following: “…The recovery in travel demand later this year is weakened by the impact of global recession on jobs and confidence. Full year passenger demand (revenue passenger kilometers or RPKs) declines 38% compared to 2019. Industry capacity (available seat kilometer or ASKs) in domestic and international markets declines 65% during the second quarter ended 30 June compared to a year-ago period, but in this scenario recovers to a 10% decline in the fourth quarter.”

Now more than ever, operational efficiency and durability matter. In these uncertain times there is a need to become more efficient and flexible – with an ability to withstand and adapt to future changes. Airlines and airports can use this time to take a good look at their operational procedures along with the equipment surrounding those operations, including their BHS. For example, some airlines are considering limiting hand luggage to a single personal item, which will drastically increase the quantity of bags in the BHS once traffic numbers start to rise. Most airports and baggage systems were not designed for this type of load and will need to be re-configured and/or re-designed to accommodate these new procedures and resulting demands. In 2019, with the possibility of endless growth on the horizon, a running BHS was good enough, the COVID-19 crisis has made it clear that “good enough” is only enough when times are good. Airports and airlines can identify and eliminate unnecessary maintenance tasks, refurbish/replace old equipment that is impacting functionality, and find better ways to leverage and enhance the capabilities of their current BHS. With revenue contraction a certainty, making the most of an aging system will be necessary.

Several airports have leveraged Vanderlande’s Life-Cycle Planning services to help them understand the limitations of their equipment, potential system bottle necks, inefficient utilization of the system, needless generic maintenance tasks, and to plan for future budgetary requirements of sustaining the BHS. Vanderlande works closely with the customer to align system performance analyses with the customer’s needs and vision for their BHS and how it supports business objectives.

Furthermore, making sure the BHS is running as efficiently as possible isn’t just important during times of contraction since airports and airlines will need to be ready when passenger travel returns to normal. So, before hitting the start button on the BHS, now is the time to take a more in-depth look at the system and conduct any required and overdue maintenance and repairs. By performing comprehensive servicing now, system life will be extended and potential failures will be avoided in the future.

The longer the effects of this pandemic last, the more the aviation industry suffers, potentially requiring more lay-offs, more government funding, temporary airport closures, and possibly mergers between airlines. Even when normal air traffic returns, it may take years for the industry to recover from this crisis.

However, inevitably, travel will eventually pick up and we will overcome this crisis. The airline industry must be ready when this happens, though it will not be as simple as flipping a switch. Airports and airlines must think ahead to how they are going to resume full operations –this planning must include the BHS. Now is the time to have a good look at the system, perform extensive maintenance and repairs, and investigate how to prolong lifecycle and increase efficiency. Having a knowledgeable and experienced partner will play a crucial role in making sure this process is done efficiently and with the airport’s best interest in mind. Vanderlande can fulfill such a role. Because in the end, nobody wants to go through a crisis on their own.

For more information contact the author Maurits Kalkhoven, Vanderlande Airports division North America.